Which of the Following Is True of New Entrants

C New entrants do not need to worry about their established customer base. A When start-up costs are low the threat of new entrants to existing businesses is high.

Evaluating The Industry Mastering Strategic Management 1st Canadian Edition

In the long run the price of the good will equal the minimum of the average cost.

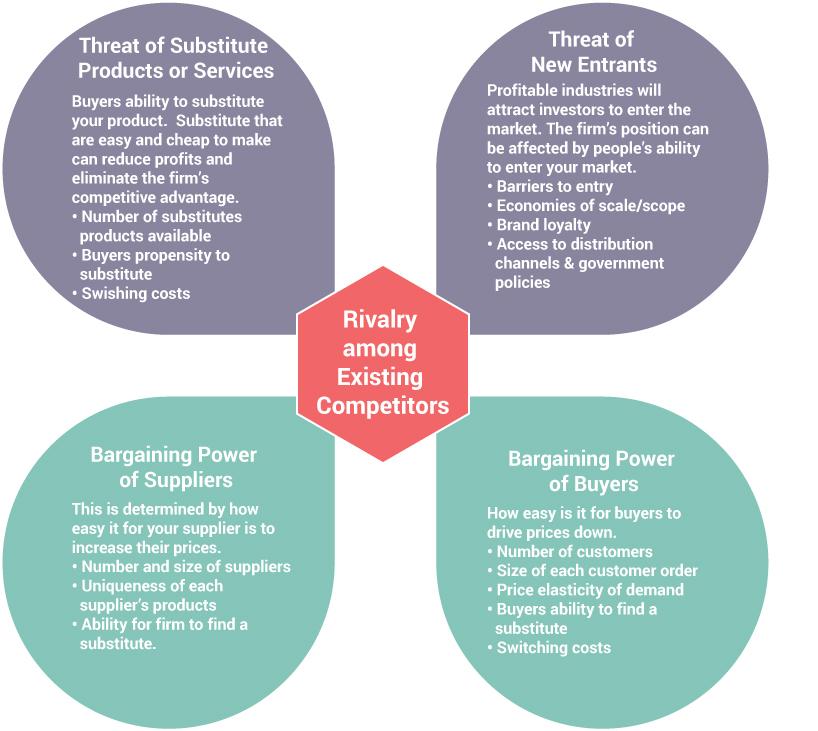

. In order to compete new entrants would also have to match or exceed this level of. First the barriers to entry are remarkably high as several airplanes are required to compete in the airline industry. High research and development costs.

B It reduced the network effects of many products. A new product or service that has the potential to reshape an industry Correct Answer. E New entrants are not constrained by lack of capital.

They do not attract new entrants as they have extremely high entry barriers due to economies of scale. A True B False 52. A True B False 53.

A Unlike incumbent firms new entrants do not have to face the high entry barriers initially. It is difficult for new entrants to focus all their energies on the opportunities offered by the new disruptive technology. They have worse technology than other companies They have no records on customers They have no market share They have no bad relationships with suppliers.

This preview shows page 7 - 9 out of 11 pages. A I is false and II is true. Which of the following statements is true.

Analytic Skills Chapter LO. The threat of the new entrants could be avoided with the following strategies. A free and competitive marketplace means the government does not interfere with prices.

A cash back guarantee offered by a watch manufacturer in case of manufacturing defects. Economies of Scale- it refers to the marginal improvement in efficiency that the firm. When firms spend huge amounts on research and development it is often a signal to the new entrants that they have large financial reserves.

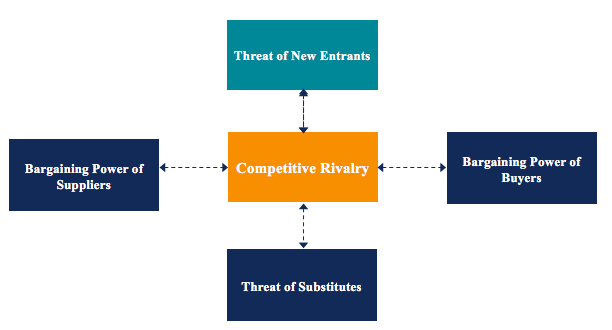

21 Which of the following is true according to Porters model. Socialism refers to economic systems where the state owns at least some parts of industry. They can often be handled by established companies without adopting new strategies.

Use the following two statements about monopolistic competition to answer this question. The threat of the new entrants could be avoided with. B The power of buyers reduces when deep discounts can be demanded of suppliers.

They strongly deter new entrants. In the short run firms may earn a profit. Differentiation decisions do not affect a companys profitability.

New entrants are not constrained by lack of capital. 13 Which of the following is true of new entrants. B I and II are true.

Operating costs are massive and there are major government regulations for. They require companies to use focus strategies to meet specialized customer needs. C I and II are false.

A fabric manufacturer offering products online and at retail stores at convenient locations. A new product or service that has the potential to reshape an industry Correct Answer. S experiences as it incrementally increase in the size.

New entrants often face the risks of product cannibalization. D It granted more power to the buyers. New entrants to the airline industry pose a very low threat to JetBlue.

A It decreased the threat of new entrants in many industries. A new product or service that has the potential to reshape an industry. Question 75 1 point Which of the following is true about new entrants.

B New entrants are embedded in an innovation ecosystem while incumbent firms are not. Differentiation and cost structure decisions do not affect one another. A cosmetic manufacturer offering different color products targeting different needs of consumers.

C Unlike incumbent firms new entrants do not have formal organizational structures and processes. Capitalism is considered to be a type of market economy. A new product or service that has the potential to reshape an industry Selected Answer.

Question 7 An industry is characterized by the presence of strong network effects high brand loyalty high economies of scale and proprietary technology among incumbent firms. Differentiation and cost structure decisions affect one another. C The power of suppliers is high when constant competition forces them to innovate.

C They are yet to develop relationships with suppliers. D They can lock in suppliers to gain a competitive advantage. In this industry which of the following is most likely to be true.

D It is difficult for new entrants to focus all their energies on the opportunities offered by the new disruptive technology. B They will have records on customers purchase habits. Let us consider whether JetBlue a company in the airline industry faces a high or low threat of new entrants.

Discuss the role of information systems in supporting business processes. They essentially enjoy a national brand loyalty. The bargaining power of suppliers is most likely high The threat of substitutes is most likely high The threat of new entrants is.

B Pressures to continue the existing out-of-date business model hamstring new entrants. Differentiation and cost structure decisions have little effect on a companys profitability. If a strong network already exists it might limit the chances of new entrants to gain a sufficient number of users.

A They have strong customer loyalty. A True B False 54. C It increased the costs of switching.

Pressures to continue the existing out-of-date business model hamstring new entrants. They are usually characterized by large mass-production operations.

Threat Of New Entrants Important Component Of Industry Analysis

Comments

Post a Comment